Home / Publications / Intelligence Memos / We Need to Get Going on Canada’s Four-Alarm Productivity Emergency

- Intelligence Memos

- |

We Need to Get Going on Canada’s Four-Alarm Productivity Emergency

Summary:

| Citation | William Robson and Bafale, Mawakina. 2025. "We Need to Get Going on Canada’s Four-Alarm Productivity Emergency." Intelligence Memos. Toronto: C.D. Howe Institute. |

| Page Title: | We Need to Get Going on Canada’s Four-Alarm Productivity Emergency – C.D. Howe Institute |

| Article Title: | We Need to Get Going on Canada’s Four-Alarm Productivity Emergency |

| URL: | https://cdhowe.org/publication/we-need-to-get-going-on-canadas-four-alarm-productivity-emergency/ |

| Published Date: | October 1, 2025 |

| Accessed Date: | November 15, 2025 |

Outline

Outline

Related Topics

Files

From: William B.P. Robson and Mawakina Bafale

To: Productivity observers

Date: October 1, 2025

Re: We Need to Get Going on Canada’s Four-Alarm Productivity Emergency

Eighteen months ago, Bank of Canada senior deputy governor Carolyn Rogers declared Canada’s poor productivity a national emergency.

Since then, things have gotten worse. Our living standards are slipping: output and incomes per Canadian will fall in 2025 for the third year running. The 9 percent drop in real (price-adjusted) machinery and equipment investment by Canadian businesses in the second quarter, which left M&E investment 12 percent below its level of just a year ago, adds urgency to Rogers’ warning that it was “time to break the glass.”

At a time when we need to equip our workers with the newest and best tools available, investment is collapsing.

Policy uncertainty and fears of economic weakness are affecting other countries, too, but that’s little comfort. As Phillip Cross wrote recently in the Financial Post, the US story is starkly different. South of the border, real business investment in M&E rose 3 percent in the second quarter, putting it 10 percent higher than a year ago. While we are rusting out, they are tooling up.

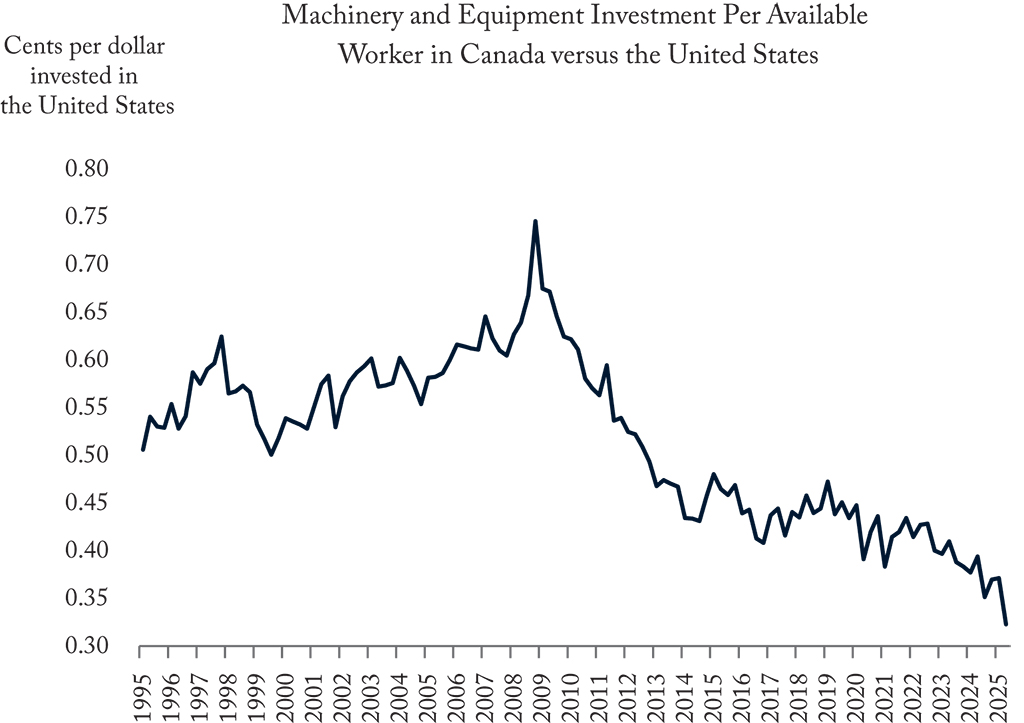

US businesses have long invested more per worker than their Canadian counterparts, as the C.D. Howe Institute has documented in a series of reports. Canada does have an edge in non-residential construction, thanks largely to the relative size of our resource industries, while the United States is ahead in intellectual property (IP) products investment, because of its larger tech sector and differences in measurement. In M&E, however, which is easier to compare across the two countries and is crucial in making the tradeable goods so important to Canada’s competitiveness in the US market, the United States has long out-paced us. In 1995, for example, after adjustment for differences in purchasing power, US M&E investment was about $5,600 per worker per year, compared with just $2,800 in Canada. In other words, for every new dollar enjoyed by the typical US worker back then, the typical Canadian worker got about 51 cents.

The gap then narrowed. By 2008, business investment in M&E stood at $7,000 per US worker versus $4,400 here. So Canadian workers were getting 63 cents per dollar compared to their American counterparts. But since then the gap has widened ominously. In the second quarter of this year, US M&E investment was at an annual rate of nearly $12,800 per worker, while Canadian was $4,100 – down to just 32 cents on the dollar (Figure 1).

In the United States, new M&E investment is outpacing depreciation and population growth, so its stock of M&E per worker is rising. In Canada, new M&E investment is falling short of depreciation and population growth, so the stock per worker is falling. US workers are getting better tools to raise output, compete and earn higher incomes. Canadian workers – including many recent arrivals during the post-COVID immigration surge – are not.

Donald Trump’s protectionism is aggravating a problem that has many roots. Over the past decade, Canada struggled launching major projects, especially in energy, much more than the United States did. We also shifted immigration toward lower-skilled labour. Meanwhile, our cautious approach to competition in such key areas as financial services, telecommunications and transportation has made these sectors less dynamic and has driven Canadian talent and investment south. Finally, and critically, Canada lost tax competitiveness with the US reforms of 2017, which spurred investment south of the border, likely to our detriment, and have now been made permanent.

Fixing these problems will not be easy. The federal government’s newfound enthusiasm for major projects and stated commitment to less and better-quality immigration sound good but have not yet yielded results. And so far Canadians are not having the conversations about tax competitiveness that should happen before major reforms.

The federal government needs to go beyond overriding its investment-stifling regulations for projects the cabinet finds appealing and overhaul the regulations themselves. It should re-orient its immigration and competition policies to set Canada on the path to higher skills and more innovation. And, pending structural tax reform, it needs to do something major quickly. If a cut in the general corporate tax rate is too hard a sell right now, it could introduce a general investment tax credit for, say, the two years it would take for a growth-friendly overhaul of business taxation.

Carolyn Rogers was right. Weak business investment in Canada is a national emergency. Our workers are not getting the tools they need to compete and prosper. The upcoming federal budget would be a good time to break that glass.

William B.P. Robson is president and CEO of the C.D. Howe Institute, where Mawakina Bafale is a research officer.

To send a comment or leave feedback, email us at blog@cdhowe.org.

The views expressed here are those of the author. The C.D. Howe Institute does not take corporate positions on policy matters.

Want more insights like this? Subscribe to our newsletter for the latest research and expert commentary.

Related Publications

- Opinions & Editorials

- Research