Home / Publications / Research / Breaking the Catch-22: How Infrastructure Banks Can Kickstart Private Investment and Overcome Market Failures

- Media Releases

- Research

- |

Breaking the Catch-22: How Infrastructure Banks Can Kickstart Private Investment and Overcome Market Failures

Summary:

| Citation | Sebastien Betermier. 2025. "Breaking the Catch-22: How Infrastructure Banks Can Kickstart Private Investment and Overcome Market Failures." Comm 683. Toronto: C.D. Howe Institute. |

| Page Title: | Breaking the Catch-22: How Infrastructure Banks Can Kickstart Private Investment and Overcome Market Failures – C.D. Howe Institute |

| Article Title: | Breaking the Catch-22: How Infrastructure Banks Can Kickstart Private Investment and Overcome Market Failures |

| URL: | https://cdhowe.org/publication/breaking-the-catch-22-how-infrastructure-banks-can-kickstart-private-investment-and-overcome-market-failures/ |

| Published Date: | May 20, 2025 |

| Accessed Date: | November 27, 2025 |

Outline

Outline

Related Topics

Press Release

Files

For all media inquiries, including requests for reports or interviews:

The Study in Brief

Large-scale public and private infrastructure investments are required to meet a wide range of infrastructure needs in Canada and elsewhere, and this is especially true for energy and digital transition projects. However, private developers frequently find themselves in an investment catch-22: they need private capital to launch, mature, and grow new infrastructure projects, but private investors are reluctant to fund the projects due to concerns that the return on investment won’t outweigh the risks.

Large-scale public and private infrastructure investments are required to meet a wide range of infrastructure needs in Canada and elsewhere, and this is especially true for energy and digital transition projects. However, private developers frequently find themselves in an investment catch-22: they need private capital to launch, mature, and grow new infrastructure projects, but private investors are reluctant to fund the projects due to concerns that the return on investment won’t outweigh the risks.- Based on stakeholder interviews and six case studies, I compare public infrastructure banks in Australia, California, Canada, the Nordic-Baltic region, Scotland, and the UK. I show how these banks address financing barriers for private developers, explore the infrastructure bank model as a cost-efficient policy tool, discuss risks and challenges, and identify policy priorities for Canada.

- To succeed, the infrastructure bank model must address several external risks and obstacles. This involves, among other things, government commitment to involve – and not to crowd out – the private sector in infrastructure markets, a unifying policy framework that considers the role of infrastructure banks versus other granting agencies, and a comprehensive evaluation framework for short- and long-run performance.

Introduction

Large-scale public and private infrastructure investments are required to meet a wide range of infrastructure needs, and this is especially true for energy and digital transition markets. The Global Infrastructure Outlook (2018) projected that US$94 trillion in investment would be required by 2040 to close infrastructure gaps and keep pace with economic and demographic shifts.1See: Global Infrastructure Hub and Oxford Economics. 2018. “Global Infrastructure Outlook: Infrastructure Investment Needs, 56 Countries, 7 Sectors to 2040.” Global Infrastructure Hub. https://cdn.gihub.org/outlook/live/methodology/Global+Infrastructure+Outlook+factsheet+-+June+2018.pdf.Similarly, a 2018 Organisation for Economic Co-operation and Development (OECD) report estimated that US$6.9 trillion is needed annually to meet sustainable development goals globally.2Source: OECD, https://www.oecd.org/en/publications/financing-climate-futures_9789264308114-en.html. More recently, a 2023 report by the International Monetary Fund (IMF) estimated that an additional US$418 billion – approximately 0.45 percent of global GDP – will be needed to set up universal broadband connectivity globally.3See: Oughton, Edward, David Amaglobeli, and Mariano Moszoro. 2023. “Estimating Digital Infrastructure Investment Needs to Achieve Universal Broadband.” International Monetary Fund, IMF Working Paper 23/27. https://www.imf.org/en/Publications/WP/Issues/2023/02/10/Estimating-Digital-Infrastructure-Investment-Needs-to-Achieve-Universal-Broadband-529669.

It will not be easy to secure large-scale private investments to meet all infrastructure needs. Developers often face an investment catch-22: they require private capital to launch and scale new infrastructure projects, but private investors are reluctant to fund the projects due to concerns that the potential returns may not justify the risks. The catch-22 results in a market failure – where the private sector alone is unable to address the investment gap. Market failures can emerge in multiple contexts, such as when private investors find the market too risky because of its “newness” and complexity, or when government policy goals are not aligned with private-sector goals, resulting in delayed market development.4See Griffith-Jones and Ocampo (2018), Marois (2014), Mazzucato and Penna (2016), and Mazzucato (2018) for research on market failures and the history of public development banks.

A key policy question is: Should infrastructure banks be used as a policy tool to address market failures, catalyze private investment in infrastructure markets, and accelerate policy goals? Over the past decade, governments have launched new infrastructure banks, including Australia’s Clean Energy Finance Corporation (CEFC) in 2012, the Canada Infrastructure Bank (CIB) in 2017, the Scotland National Investment Bank (SNIB) in 2020, and the United Kingdom Infrastructure Bank (UKIB) in 2021. Since then, the purpose and utility of infrastructure banks have become a hot topic of debate. For instance, in 2014, a bill was introduced into the Australian Parliament that proposed to abolish the CEFC. In 2022, the Standing Committee on Transportation, Infrastructure, and Communities in the House of Commons of Canada recommended abolishing the CIB. In October 2024, the UK government decided to rebrand UKIB as the National Wealth Fund (NWF) with a mandate extending beyond infrastructure.

This paper presents important considerations about how infrastructure banks can be a cost-efficient policy tool to catalyze private investment in infrastructure markets. I explain how infrastructure banks resolve market failures and review their operational strengths and limitations in relation to other policy tools such as grants, subsidies, tax credits, and regulations. I then discuss challenges that infrastructure banks encounter when carrying out their mandates, such as the risk of crowding out the private sector, the management of investment risks, and the measurement of performance. Finally, I present strategies to support success and highlight priorities for Canada going forward.

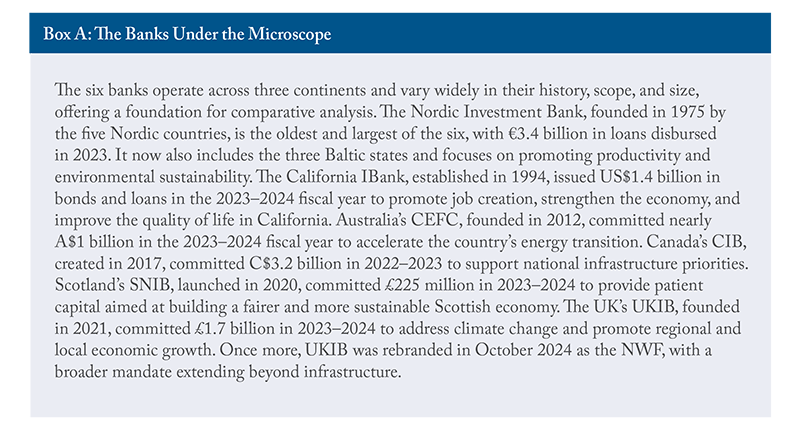

The analysis begins by conducting detailed interviews and case studies of six infrastructure banks: Australia’s CEFC, the California Infrastructure and Economic Development Bank (IBank), Canada’s CIB, the Nordic Investment Bank (NIB), Scotland’s SNIB, and the UK’s NWF. These case studies provide an “under the hood” view of how infrastructure banks operate to resolve market failures and accelerate policy goals in a broad range of markets. These include particularly difficult energy markets, such as “carbon farming” and “green steel,” and digital transition markets aimed at achieving universal broadband connectivity.

I discuss three main insights gained from the case studies and interviews. First, I explain why private developers struggle to secure financing in new infrastructure markets. The problem is that private investors view new infrastructure markets as complex, unfamiliar, and high risk. It is not like buying a toll bridge or a hospital that has an established performance history with an operable risk-return evaluation framework. For instance, private investors developing a new electric vehicle (EV) charging network face the risk of low utilization rates over extended periods, leading to unstable revenue. Because the market is so new, there is no performance history to inform a reliable risk-return assessment.

Even more challenging for private investors is the fact that new infrastructure markets often need to set up entire supply chains before launching. Building supply chains requires exceptional coordination between stakeholders. For example, offshore wind power requires the infrastructure to import, transport, assemble, and maintain wind turbines, as well as a transmission grid to connect them to the mainland and sufficient energy storage capacity to support the power supply. New infrastructure markets can also be capital-intensive and require large-scale capital commitments involving multiple lenders, thus needing additional financial coordination.

Second, I gain insight into how infrastructure banks operate to resolve market failures, catalyze private investment in infrastructure markets, and accelerate policy goals. As government agencies, infrastructure banks have higher risk tolerance and longer time horizons than private investors, along with a unique set of financing levers.5As government agencies, infrastructure banks benefit from the government’s power to tax, which guarantees revenue. Thus, they can bear long horizons and have a high risk tolerance, which gives them scope to maneuver in a variety of contexts. The government can also borrow at lower interest rates than the private sector. However, as Boyer, Gravel, and Mokbel (2013) show, the true cost of public funds should also account for the value of the implicit option granted by taxpayers to the government to obtain from them additional funds to cover a project’s possible non-profitability. This gives them the flexibility to design creative financial strategies to resolve market failures. For example, infrastructure banks can use concessional financing, such as providing loans at below-market rates for “high-impact” projects. They can transfer the risk of the projects from private investors to the public by taking on junior loan positions, scheduling flexible loan terms, and providing loan guarantees. Infrastructure banks can also act as anchor investors and coordinate the stakeholders along the supply chain. Finally, by taking market leadership and establishing track records for new projects, infrastructure banks can establish an operable risk-return evaluation framework and thus expand the universe of investment opportunities for private investors.

Third, I find that the six infrastructure banks operate a variety of investment strategies within a diverse range of markets. Each bank has a distinctive investment focus based on its government’s unique priorities, applies a different combination of financing levers, and uses a distinct investment approach depending on the types of market failures it addresses.6The Nordic Investment Bank aims to promote productivity gains and environmental benefits, while Australia’s CEFC focuses mainly on decarbonization. Strategic priorities may include targeted population groups, like Indigenous communities in Canada and low- to moderate-income communities in California. Strategic priorities can change over time, as seen with the Nordic Investment Bank, which introduced financing for defence-related industries in 2022 amid growing geopolitical concerns. Each infrastructure bank also applies a different combination of financial levers. For example, Australia’s CEFC, the UK’s NWF, and Canada’s CIB provide concessional financing, while Scotland’s SNIB does not. California’s IBank, the Nordic Investment Bank, and the UK’s NWF utilize different forms of loan guarantees. Finally, each infrastructure bank uses a distinct investment approach depending on the types of market failures it addresses. Canada’s CIB intervenes at the early stage of the project and has an exit strategy as soon as the private market is established, while Australia’s CEFC and Scotland’s SNIB remain involved and continue to develop their markets.

From my analysis, I synthesize a framework showing the contexts in which the infrastructure bank model can create value as a cost-efficient policy tool in the government ecosystem. Infrastructure banks are generally more effective at promoting positive externalities – such as clean energy from new infrastructure projects – than at addressing negative externalities like pollution from existing sources. Distinct from grant and subsidy programs whose financial outlay cannot be recouped, infrastructure banks invest government funds with a goal to recoup 100 percent of their investments and generate a financial return while also capturing the positive externalities from the new infrastructure, such as job creation and decarbonization. Unlike state-owned enterprises, infrastructure banks invest capital with the goal of having the private sector take over and develop the market on its own. Infrastructure banks have the potential to be most effective in infrastructure markets that offer attractive business opportunities but confront a market failure that inhibits private investment.

However, the infrastructure bank model faces several external risks and obstacles that can hinder its effectiveness. One obstacle is the weak government commitment to involving the private sector in infrastructure markets. Without strong government commitment and a supportive regulatory environment, infrastructure banks may struggle to build partnerships with private investors. Another risk factor is the absence of a unifying policy framework that considers the distinctive purposes of infrastructure banks versus grant agencies. Without one, there can be a lack of coordination that results in competition between the agencies for similar projects. Yet with one, each agency can use its different strengths to work strategically together and make the most of its resources. Sudden government policy shifts present another risk factor that makes it difficult for infrastructure banks to implement long-term projects. There is also the conflict between short-term versus long-term expectations: stakeholders may have short-term expectations on each investment venture, but this conflicts with the infrastructure bank’s objective to provide patient capital for long-term infrastructure projects. Many projects need infrastructure banks to come in early, when the risk is highest, but this means that it may take years before positive returns are earned, thus further complicating the way infrastructure banks are evaluated.

The infrastructure bank model is also complex to operate and faces governance and operational challenges. One such challenge is crowding out the private sector if an infrastructure bank becomes too established in a market. This can happen if the banks do not sufficiently engage with the private sector and end up providing loan terms that private lenders cannot compete with. The absence of an independent investment framework presents another challenge, which can result in a suboptimal selection of projects and management of investment risks. Infrastructure banks are most effective when they establish strategic priorities based on government policy while having the ability to make independent investment decisions and operate like private-sector institutions. Lacking a clear and comprehensive performance evaluation framework presents an additional challenge because infrastructure banks have multiple bottom lines that include risk-adjusted returns and societal outcomes such as decarbonization and productivity enhancement.

Despite the operational complexity of the infrastructure bank model, this analysis presents a strong theoretical and practical case for the infrastructure bank model as a cost-efficient policy tool to catalyze private investment in a broad range of infrastructure markets. In this paper, I provide several suggestions on how to resolve the main challenges and maximize the infrastructure banks’ efficacy. To set realistic reader expectations, the case studies I present do not represent the entire portfolio among the infrastructure banks. Furthermore, the case study analysis is based on qualitative interviews and is not a quantitative analysis of the performance data. Most of the infrastructure banks in this study are young and have committed patient capital to long-term projects that need to mature. Such a quantitative analysis will be an important next step to advance the discussion.

1. Case Study Analysis of Market Failures and Solutions

1.1 Market Failures and Research Process

The case studies are based on detailed interviews with senior executives from six infrastructure banks and cover a wide range of markets: carbon farming (Australia), battery energy storage (Canada), offshore wind power (Scotland), green steel (Nordic-Baltic region), small business loans (California), and universal broadband coverage (UK). Each illustrates the different market failures inhibiting private investment in a market and how the infrastructure bank addresses them.

I use the framework designed by Mazzucato and Penna (2016) to categorize the different types of market failures. There are four main categories:

- Venture: When emerging markets are too risky for private investors because of their newness, their complexity, and the consequent lack of a proven and consistent revenue stream.

- Countercyclical: When private markets are short-run and highly cyclical, thus hurting long-term growth.

- Development: When private markets lack competition between established, giant players and new entrants cannot break into the market.

- Challenge-led: When government policy goals deviate from private-sector investment goals, resulting in delayed market development.

Five out of six case studies focus on a market failure in the venture category, indicating that infrastructure banks are particularly active in this space. All case studies show why private developers struggle to secure financing for new infrastructure projects. In some markets, the challenge lies in a high degree of fragmentation, which demands extensive due diligence for relatively small transactions, such as those in carbon farming or small business loans. In others, the main obstacles include significant exposure to external risks, such as volatile critical mineral prices (as seen in battery energy storage), the need to build a fully coordinated supply chain (as in offshore wind), or the requirement to secure large-scale financing from multiple lenders (as with green steel projects).

Generally, the cases represent market failures in the venture category, but there can be an overlap with other market failure categories. For example, Australia’s carbon farming industry and Canada’s battery energy storage industry both face volatile carbon and lithium prices due to supply-demand imbalances and are nascent industries. By intervening in those markets, the CEFC and the CIB play a counter-cyclical role in addition to a venture role. Similarly, Scotland’s offshore wind industry lacks a strong local economy around wind energy, creating dependency on external suppliers. By developing the local industry, Scotland’s SNIB plays a development role in addition to a venture role.

The sixth case study is an excellent example of a challenge-led market failure. The UK’s Project Gigabit program had to resolve the potential delay in setting up broadband connectivity in rural areas. This case study shows the benefit of having an integrated policy framework to help government agencies strategically distribute capital in the most cost-efficient way.

In each case study, the infrastructure bank uses various strategies and financing levers to attract private investment. These include concessional financing (Australia’s CEFC), flexible loan terms (Canada’s CIB), loan guarantees (Nordic-Baltic’s NIB, California’s IBank), stakeholder coordination across the supply chain (Canada’s CIB, Scotland’s SNIB, the UK’s NWF), and establishing a track record to reduce perceived risk (Australia’s CEFC, Canada’s CIB, California’s IBank). There is no cookie-cutter solution for these infrastructure projects, and each problem needs to be addressed within its own unique context.

I also interviewed senior executives from other infrastructure banks, including New Zealand’s Green Investment Fund and Saudi Arabia’s National Infrastructure Fund, and from private-sector developers who obtained financing from the infrastructure banks. In total, I conducted 20 interviews from August 2024 to November 2024.

1.2 Carbon Farming, Australia

The Australian government has focused on agricultural carbon sequestration to meet its goal of net-zero emissions by 2050. The objective is to grow carbon sinks by incentivizing farmers to cultivate part of their farmland for carbon capture and biodiversity. Through carbon sequestration activities, such as planting trees, farmers can generate and receive Australian carbon credit units (ACCUs). Farmers are then able to sell ACCUs on the carbon market to industries seeking to offset their carbon footprint and meet their carbon reduction quotas. This creates additional income for farmers and a pathway to net-zero for other industries.

Even though the Australian government has made substantial policy efforts to mobilize carbon farming, it has been difficult to motivate institutional lenders and farmers to participate. Banks are hesitant to make loans to carbon farms because agriculture is a highly fragmented market where most farms are small to medium in size. This requires banks to carry out loan due diligence for every farm. Carbon farming is also a new industry, and bank due diligence teams do not have a clear framework that outlines how to optimally configure the land to manage both primary agricultural production and carbon farming simultaneously. This makes it risky for banks to issue loans.

On the agricultural side, farmers lack the incentive to pursue carbon farming because the carbon market presents a pricing volatility risk. Since carbon sequestration crops like trees need a few years to mature after planting in order to qualify for ACCUs, farmers face the risk of ACCU pricing volatility during the maturation period. Added to this, most farms carry high debt, and farmers are conservative about taking on more debt to plant carbon sinks, especially since they are already exposed to the seasonal volatility of crop prices. Finally, farmers are exempt from domestic carbon reduction targets and are therefore not obligated to pursue carbon abatement activities.

Australia’s CEFC stepped in to help accelerate the government’s carbon emission reduction goals and jump-start the carbon farming industry. In January 2025, CEFC invested A$200 million with Rabobank Australia to give concessional financing to farmers for carbon farming projects. The transaction is designed to cover loans up to A$5 million for each loan application. In addition, the CEFC and Rabobank have put together a “how-to” guide for farmers that discusses carbon credit management. The guide helps farmers understand that ACCUs are a valuable asset – one they can sell on the carbon market, hold until prices rise, or use to voluntarily offset their own emissions. By working together with a bank, the CEFC helps lower loan costs for carbon farming projects, establishes a loan framework, and educates farmers about the benefits of carbon farming.

In addition to this new loan program, the CEFC, along with institutional investors, has invested in large agriculture platforms. These platforms aggregate ACCU production across farming properties and result in a more stable supply of carbon credits, which stabilizes carbon prices and thus de-risks overall farming income. The platforms also provide scale, making the carbon farming industry more attractive to institutional investors. This case study illustrates how the CEFC helped catalyze private investment for a new infrastructure market by creating aggregation and scale, connecting farmers with banks, building a structured and streamlined process to access loans, and helping to support the efficient operations of the ACCU markets.

1.3 Oneida Energy Storage, Canada

Energy storage is rapidly emerging as critical infrastructure for managing the intermittent output of renewable energy sources like wind, solar, and hydro. In 2019, NRStor Inc. and the Six Nations of the Grand River Development Corporation submitted a proposal to the Ontario government to build Canada’s first major clean energy storage facility – and one of the largest in the world – in southwestern Ontario. The project, now under construction, will have a storage capacity of 250 megawatts/1,000 megawatt-hours.7For more, see: https://news.ontario.ca/en/release/1004567/ontario-completes-largest-battery-storage-procurement-in-canada-to-meet-growing-electricity-demand. The storage facility will offer several benefits: energy arbitrage, by smoothing out demand peaks; fast frequency response, by helping maintain a stable power supply; and “black start” capability, allowing the grid to restart quickly after a shutdown. The facility will be built and operated by private developers, who will provide electricity storage services to the Independent Electricity System Operator (IESO), the Crown corporation that manages electricity in Ontario.

The energy storage market is new, and the cost of building and operating such a massive facility is difficult to evaluate. The risk for the government is potentially overpaying for the electricity storage services. For private developers, a project of this scale carries important risks regarding the availability and cost of materials. This new energy storage facility will maintain an extensive collection of “megapack” lithium-ion batteries. The cost of the megapack batteries depends on the price of lithium carbonate, which is volatile. When developers order batteries, there is a time lag from when the battery order is placed to when the batteries are shipped. This lag is key because the cost of the batteries is determined when they are shipped, and during the time between ordering the batteries and shipping the batteries, lithium carbonate prices may have increased. Developers are therefore exposed to the risk of lithium carbonate pricing volatility, resulting in soaring battery costs. For example, between 2020 and 2024, lithium carbonate prices fluctuated between CN¥71,500 per ton and over CN¥600,000 per ton (about C$13,500 to C$114,000 per ton as of early 2024) due to increasing demand for EVs and limited and volatile lithium production.

The CIB stepped in to bridge the gap between the government and private developers. Four companies – NRStor, the Six Nations of the Grand River Development Corporation, Northland Power, and Aecon Concessions – formed a joint venture called Oneida Energy Storage LP to build and operate the energy storage facility in Ontario. The CIB provided a loan up to C$535 million, where payment and sizing terms were informed by the extent to which risks materialized for both Oneida Energy and the IESO. The CIB’s financing package was based on the current lithium prices and was distributed in two forms: (1) a short-term construction loan; and (2) a long-term loan to help partners tolerate risks associated with the first-of-a-kind facility and fluctuating critical minerals costs. The loan made the project less risky for both the government and the private developers.

Since the CIB is a government agency with a majority of staff from the private sector, they were able to establish credibility and trust with both the private and the public sector stakeholders. The CIB was also able to meet its mandate to empower Indigenous communities by working with the Six Nations of the Grand River Development Corporation. Finally, by supporting this project, the government acquired the knowledge to meet similar infrastructure needs in the future.

1.4 Ardersier Port, Scotland

The Scottish port of Ardersier near Inverness was originally used in the 1970s and 1980s to build oil and gas platforms in the North Sea, but closed down in 2001. It reopened in 2014 because both the Scottish and UK governments wanted to develop a robust fixed and floating offshore wind industry that could produce 50 gigawatts of wind by 2030. Ardersier Port has the ideal profile for a wind energy super-hub because of its access to the North Sea’s abundant wind power and its surrounding deep water, which can easily accommodate large cargo ships to bring in equipment and materials.

Securing private investment to develop the port for wind power was problematic because an operational wind energy super-hub needed a complete and coordinated supply chain. That supply chain was complex and needed to account for specialty equipment like giant wind turbines, transported on enormous cargo ships, that had to be stored at the port. Besides transportation and storage, there were the challenges of assembly, installation, maintenance, staff, and expertise – all heavily reliant on external providers. Offshore floating wind farms posed an added challenge because they required the largest turbines and have unique infrastructure and maintenance needs. To establish a functional supply chain ecosystem at the port, all private actors needed to coordinate and work collaboratively with one another across the entire supply chain.

In 2023, Haventus, a private developer owned by Quantum Capital Group, a Texas private equity firm in the energy industry, saw Ardersier’s potential to become an offshore wind hub and invested £300 million in equity investment for port redevelopment. This investment was followed in 2024 by a £100 million credit facility provided by Scotland’s SNIB and the UK’s NWF. The infrastructure banks’ investment provided the necessary capital to complete the core supply chain. In particular, the capital went toward the development of a new 650-meter quay wall and quayside to accommodate larger vessels. Additionally, SNIB and NWF’s large investment gave Haventus confidence that both governments were committed to the long-term success of the port. These conditions would, in turn, encourage new private developers to come in and contribute to the different components of the wind ecosystem, such as offshore battery storage, and re-establish the port as a major local employer. The Ardersier Port case study illustrates how infrastructure banks can participate as long-term anchor investors to help establish supply chains and catalyze large-scale private investment in strategic infrastructure.

1.5 Stegra Green Steel, Sweden

Steel manufacturing emits 7-9 percent of the world’s carbon emissions and is a notoriously hard-to-abate industry because its carbon-intensive manufacturing process doesn’t have an easy-to-implement, clean alternative (Kim et al. 2022). In 2020, Stegra (formerly H2 Green Steel), a privately owned company, established a 270-hectare green steel manufacturing plant in the town of Boden in the interior of northern Sweden. The objective of this project was ambitious: reduce CO2 emissions by up to 95 percent relative to traditional steel manufacturing and become the first large-scale green steel plant in the world that could produce 5 million tons per year of high-quality green steel to market by 2030.

Stegra needed to address several challenges. The first was to make the large-scale manufacturing process economically feasible. The town of Boden was ideally located to create efficiencies because of its access to raw materials and its proximity to the Lule River, which powers Sweden’s hydroelectric energy. Boden provides easy access to the power grid, which is essential to the green steel plant’s 700-megawatt hydrogen facility, which requires an abundant supply of clean electricity to produce the quantities of green hydrogen needed to manufacture steel.

The second challenge was to establish the supply chain. Stegra secured long-term agreements for its raw materials and electricity needs and also secured binding 5-to-7-year customer agreements for 60 percent of the initial yearly production. There was demonstrated demand for green steel by end-of-line producers, especially from European car manufacturers pursuing net-zero Scope 3 emissions, which requires the entire value chain to be green, and willing to pay a premium for green steel.

The third challenge was obtaining large-scale financing. Setting up the plant was capital-intensive and required over €6 billion of equity and debt investments. Due to the large scale of the new project, a wide group of lenders joined a complex project finance setup, which in turn required support from suppliers and end-of-line producers as well as risk sharing via state guarantees and support from domestic and international financial institutions.

In December 2023, NIB gave a 12-year loan of €57 million to Stegra. By participating as a lender, NIB provided financing and also signalled its support, conducting its standard due diligence process to verify the parameters of the case and its expected impact. In addition, NIB is an implementing partner to the InvestEU guarantee program, which provides NIB with portfolio insurance for high-risk investments. InvestEU is a European Union (EU) agency set up to insure the loans issued by its partners. The Stegra Green Steel project received approval from the InvestEU committee, which provided indirect risk-sharing support and added an extra layer of credibility to this important, large-scale initiative in the hard-to-abate steel sector.

1.6 COVID-19 Micro-Loan Guarantee Initiative, California

California’s IBank illustrates another way that infrastructure banks can use loan guarantees to help resolve a market failure. The market failure in this case was supplying small businesses with loans. Small businesses are last in line for loans because banks see them as high risk. Also, due diligence for a US$50 million loan is the same as for a US$500,000 loan. From a bank’s point of view, small loans are less cost-effective. To address this issue, California established the Small Business Loan Guarantee Program, providing a group of private lenders with guarantees on the loans they extend to small businesses. The IBank loan guarantees help reduce the risk for private lenders when issuing smaller loans.

This program became critically important during the COVID-19 shutdowns. On March 19, 2020, California’s COVID-19 stay-at-home order was issued. There was high uncertainty about the survival of small businesses. Ten days later, on April 2, a disaster relief micro-loan guarantee program was put into effect to help small businesses survive. This was made possible by an emergency infusion of US$50 million in appropriations to IBank, which restructured its traditional Disaster Relief Loan Guarantee Program to distribute the US$50 million through micro-loan guarantees. The IBank micro-loan program guaranteed up to 95 percent of loans instead of the traditional 80 percent maximum at The Wall Street Journal prime rate (WSJP) plus 1 percent. This higher coverage helped neutralize default risk and was both an incentive and a condition to lenders so that they would provide loans at a lower interest rate to small businesses. The program was active through to Dec. 4, 2023, and provided US$110 million in micro-loans to 2,381 businesses. The loans were essential for small businesses to outlast COVID-19 shutdowns, and 87 percent of loans went to minority-owned, women-owned, and low-to-moderate-income area businesses. The average micro-loan issued was under US$50,000, and the default rate was much lower than bank estimates, i.e., with a net charge off of 4.6 percent in 2023 and 8 percent in 2024. This was impressive given the magnitude of the pandemic and the adverse effect that COVID-19 had on the small business community.

The case study illustrates how nimble the IBank had to be in order to launch a micro-loan program within two weeks after the shutdown announcement. It is an example of how infrastructure banks have the benefit of adapting rapidly to changing circumstances because they operate like private institutions. The government continues to recoup its US$50 million outlay through repayment, thus making the micro-loan program cost-efficient compared to using grants or subsidies.

1.7 Project Gigabit, United Kingdom

In 2022, the UK government launched its ambitious £5 billion “Project Gigabit” program to extend broadband coverage throughout the UK. The policy measure sought to deliver gigabit broadband to 85 percent of its premises by 2025 and 99 percent by 2030. This scale of broadband coverage would open economic opportunities, revitalize communities, and help businesses transition to net-zero. The goal was to coordinate with the private sector to build the gigabit-broadband infrastructure, but Project Gigabit would focus on bringing broadband to the harder-to-reach areas.

As of January 2022, the UK’s telecommunications regulator, Ofcom, reported that only 64 percent of premises had access to gigabit broadband.8See: Hutton, Georgina, and Adam Clark. 2022. “Gigabit-Broadband: Funding for Rural and Hard to Reach Areas.” UK House of Commons Library, Research Briefing CBP 9207. https://commonslibrary.parliament.uk/research-briefings/cbp-9207/#:~:text=The%20Government’s%20target%20is%20for,funding%20to%20deliver%20gigabit%2Dbroadband. For private developers to get involved, certain financing challenges had to be resolved. First, several rural communities were difficult to reach and, for developers, they presented an investment disconnect between resource outlay and profit potential. Second, developers needed financing, but lenders have capacity and exposure limits. For the private market to meet Project Gigabit goals, developers needed to access more financing than what lender capacity limits would allow.

The NWF worked with the government to resolve these financing barriers. The government provided an integrated policy framework that categorized UK regions into three groups based on commercial viability: (1) profitable areas, consisting of densely populated urban communities able to support multiple network providers; (2) semi-profitable areas, with smaller populations that could not sustain multiple providers, leading to slower broadband rollout; and (3) unprofitable areas, made up of remote or hardest-to-reach communities where broadband deployment would not occur without additional public funding.

A strategic distribution of capital corresponded to the framework in the following ways. The premises in the profitable category did not receive any financial intervention. For premises in the semi-profitable category, the NWF provided loans to developers to expedite the digital transition. The loans lessened the private lenders’ risk capacity constraints and financed new alternative network developers that were not already connected to a bank. For premises in the non-profitable category, the UK government provided additional subsidies to partially cover installation costs.

The NWF’s partnership with the government illustrates the efficacy of having an integrated framework to help government agencies strategically distribute capital in the most cost-efficient way. Working together with other government agencies, the NWF helped to ensure that public funding would be used prudently to achieve the desired policy outcome.

2. Discussion and Policy Implications

From my analysis, I present the contexts in which infrastructure banks can be a cost-efficient policy tool in the broader ecosystem of government programs. I then discuss the main risks and obstacles that can hinder their effectiveness and present strategies to support success.

2.1 A cost-efficient policy tool to “crowd-in” private investment

Infrastructure banks are one of several policy tools available to the government, along with tax credits, grants, subsidies, and regulations. Each policy tool can be efficiently used to address the economic trade-offs that the government has to consider.

Positive versus negative externalities: To achieve its economic goals, the government must choose the policy tool best suited to promoting positive externalities, or broader societal benefits, and addressing negative ones. Infrastructure banks are particularly effective at encouraging positive externalities, as they are specifically designed to attract private investment into infrastructure projects that generate broad public benefits. For example, the development of new infrastructure, such as battery energy storage, facilitates the production of clean energy. The infrastructure bank model is less effective at addressing negative externalities, such as pollution from existing sources. Alternative policy tools like regulation and taxes provide a more effective solution. For example, carbon pricing schemes can be designed to internalize the cost of carbon and reduce pollution.

Different types of investment-based agencies: Infrastructure banks are one of several types of government agencies that make investments to generate positive externalities. The level of control that the government wants over an economic market is the principal difference between these agencies. As Figure 1 shows, if the government wants high public control over a market (right of the spectrum), it can become a majority shareholder through Crown corporations like Ontario Power Generation. Public-private partnerships (PPPs) are another way for the government to maintain ownership of the asset (Istrate and Puentes 2011) while working with the private sector in infrastructure. A good example is the Windsor-Detroit Bridge Authority, a not-for-profit Canadian Crown corporation that was created to manage the procurement process for the design, construction, financing, operation, and maintenance of the Gordie Howe International Bridge connecting Windsor and Detroit through a PPP. If the government wants to be hands-off and have the private sector drive a market’s growth and productivity, the government can use infrastructure banks to resolve the market failures inhibiting private investment (left of the spectrum).

Investments versus grants and subsidies: Grants and subsidies are another way for the government to stimulate private markets and have the advantage of deploying capital across a broad range of needs. The private sector also prefers them because there is no repayment condition. However, without repayment conditions, they become expensive to the taxpayer since the financial outlay cannot be recouped.9Grants are generally non-repayable funds. Tax subsidies reduce the amount of taxes owed and therefore reduce the government revenue. Investments, on the other hand, are more cost-efficient because the government can recoup its financial outlay with added interest. For example, the Nordic Investment Bank aims to return 20-30 percent of its net profit to its government sponsors as a dividend. However, investments are more complex to operate, and incentives are needed to get the private sector to participate.

Figure 2 shows where the government intersects with private interest in a market and how this affects its strategic choice of which government agency to use. Markets that generate low to no private interest need government grants and subsidies to develop. Examples include early-stage technologies with high uncertainty, such as space exploration research or COVID-19 vaccines developed during the pandemic. In the middle of the spectrum are the markets that have high business potential, but market failures inhibit private investment. The government can use infrastructure banks to resolve the market failures and push the markets into the range of high private interest. Markets that generate high private-sector interest do not need government involvement because they stimulate growth and productivity on their own.

Investments versus regulation: The government can also adjust the regulatory framework to stimulate private markets and encourage positive externalities. Take the example of intellectual property. The government incentivizes companies to invest in research and development by issuing patents that will give them a temporary economic monopoly to recoup their investments. But the incentive-based regulatory approaches can unintentionally lead to permanent monopolies in infrastructure markets, driven by geographic advantages and high barriers to entry.

2.2 External Risk Factors and Obstacles

The infrastructure bank model faces several external risks and obstacles that can hinder its effectiveness as a policy tool.

No government commitment to private-sector market development: The success of the infrastructure bank model depends on the government’s commitment to a private-sector role in infrastructure. It is not enough for the government to create an infrastructure bank with the hope that it will then resolve market failures on its own. Without a government’s committed private-sector role in infrastructure, its infrastructure banks may struggle to build partnerships with private investors. For instance, the Global Infrastructure Hub reported in 2023 that high regulatory capital charges on infrastructure assets turn private banks away from infrastructure investments.10See: https://www.gihub.org/articles/banks-are-critical-for-closing-infrastructure-deficits-but-banking-regulations-are-not-supportive/. Such regulatory deterrents can make it difficult for infrastructure banks to build partnerships with private banks.

No unifying policy framework: Governments manage a portfolio of agencies which can have overlapping mandates. This may lead to a situation where an infrastructure bank, a development bank, and a grants agency operate in the same market sector. The result can be an inefficient use of each agency’s resources and unnecessary competition for projects. The government needs a unifying policy framework that outlines the distinct purpose of each agency and allows the government to strategically allocate a project to the agency that will be the most effective. The UK’s Project Gigabit presents a good example of how a unifying policy framework strategically uses grants and infrastructure banks to minimize inefficient spending and maximize private investment.

Policy instability: Sudden policy shifts – like removing tolls from roads or changing rules on private infrastructure ownership – present a disquieting risk for infrastructure banks. Major infrastructure projects can take years to develop and therefore require a stable policy environment to succeed. Major and long-term infrastructure projects are only viable as long as certain policies

are sustained.

Expectation timelines: Short-term expectations are incompatible with long-term investment timelines and present a problem for infrastructure banks. For many countries, the infrastructure bank model is new, and its purpose is different from that of a grant agency. Specifically, grant agencies distribute subsidized funding while infrastructure banks invest. Large infrastructure projects may take years before returns are earned. It also takes time to set up an infrastructure bank properly because investment decisions and negotiations are complex and require forethought and consideration. Infrastructure banks must be set up with strong governance and an independent investment framework, and they must acquire staff with market expertise to effectively select investment projects and make sound investment decisions.

2.3 Governance and Operational Challenges

The infrastructure bank model is complex to operate and faces several governance and operational challenges. There are some key challenges – such as how to avoid crowding out private investment, governance, and performance measurement – whereby strategies are needed to address these issues and maximize the banks’ efficacy.

Crowd-in versus crowd-out: The purpose of an infrastructure bank is to catalyze private investment and stimulate growth in a privately run market. To do this, it needs to crowd-in private investors. But it can end up doing the opposite and crowd-out the private sector if it becomes too established in a market or too financially generous. This is most likely to happen when the infrastructure bank does not sufficiently engage with the private sector and makes loans that give substantial concessionary terms that private lenders cannot compete with.

Infrastructure banks can mitigate this risk by establishing clear entry and exit strategies. The entry strategy should be a function of the private sector’s interest in the market. Ideally, the terms should be designed to cover the initial risk inhibiting private investment without being so liberal that recouping the amount invested becomes improbable. This calibration is essential. If terms are so generous that they prevent the private sector from competing, the result is a permanent market failure where the private sector is unable to operate and compete without receiving an ongoing subsidy.

A clear exit strategy is also important to prevent infrastructure banks from becoming competitive with the private sector in the medium term. What the exit strategy looks like depends on the category of market failure that the infrastructure bank is addressing. For example, infrastructure banks operating in the venture category should exit the market as soon as the private sector is willing and able to step in. Similarly, infrastructure banks operating in the challenge-led category should exit the market once the policy challenge is either met or fully addressed by the private sector. Ideally, an infrastructure bank is designed to be continuously on the go, always scoping out the next market opportunity where private investment is inhibited by a market failure that it can resolve. After resolving the market failure, the infrastructure bank hands over the baton to the private sector to develop and grow the market on its own.

Governance: The value of the infrastructure bank model lies in its ability to combine two strengths – (1) the government’s capacity to take on long-term risks and benefit from the positive externalities of new infrastructure, and (2) the private sector’s business expertise and operational flexibility. The degree to which this model is an effective policy tool is conditional on having a strong governance structure where the government sets strategic priorities for the infrastructure bank but delegates the investment decisions and operations to a management team of industry experts who have the requisite skills and tools to identify and resolve market failures. This structure should be overseen by a board of professionals with experience in the public and private sectors, who remain attuned to market developments and convert key policy objectives into clear and tangible investment targets. Ideally, the management team is recruited from the private sector for their expertise and ability to meet those targets.

There are several benefits to having infrastructure banks operate like a private-sector institution. One benefit is having professional investment managers identify market failures, structure deals, and manage critical investment risks. Another benefit is the credibility that the staff’s professional investment experience and expertise bring to the government when negotiating with private investors.11As Fernández-Arias et al. (2020) explain, market failures are not directly observable, and development banks have unique vantage points for observing them. Added to this, the staff’s private-sector knowledge ensures that the government receives a fair deal from the transactions. Last but not least, the more independent an investment process is, the less risk there is that the infrastructure bank’s investments will be impacted by political agendas.12Carvalho’s (2014) study of government-owned banks in Brazil suggests that politicians use public bank lending to shift employment towards politically attractive regions and away from unattractive regions – especially before competitive elections.

This combined “public-private” governance structure has proven successful in other contexts. Canadian public-sector pension funds have adopted this structure, and they operate at an arm’s length from their government sponsors with management teams recruited from the private sector (World Bank 2017).13The Canada Growth Fund, established in 2022, is managed by PSP Investments and thus leverages the investment framework of the Canadian pension fund model. Ambachtsheer (2021) and Beath, Betermier, Flynn, and Spehner (2021) show that these pension funds have been able to generate strong risk-adjusted returns over the past decades, which in turn has allowed their government sponsors to remain well funded in spite of decreasing interest rates and increasing life expectancy.14One difference between infrastructure banks and Canadian public-sector pension funds is that infrastructure banks are designed to implement evolving policy goals, whereas most pension funds have a mandate strictly focused on generating returns for pensioners. One should therefore expect greater political intervention in projects and organizational goal-setting among infrastructure banks.

Performance measurement: Lacking a clear and comprehensive performance evaluation framework presents an additional challenge to the infrastructure bank model. The difficulty is that infrastructure banks have multiple bottom lines that include risk-adjusted returns and societal outcomes such as decarbonization, productivity enhancement, and financial empowerment of low-income and minority groups. Without a clearly established, comprehensive performance evaluation framework from the outset, performance becomes hard to measure.

A set of key performance indicators (KPIs) should be clearly defined, publicly disclosed, and periodically reviewed and updated by the board. Since the infrastructure bank’s purpose is to catalyze private investment, KPIs should include the level of private investment raised and the private-sector growth in the underlying market after the infrastructure bank’s exit. If a government’s policy focus includes societal goals for a bank’s performance, then KPIs should reflect this by including outcome-based metrics such as the amount of carbon reduction resulting from the new projects, the total production of renewable energy electricity, or the total loan volume for underserved communities. Given the long-term nature of infrastructure bank investments, targets for these metrics should be set at the portfolio level and over medium- and long-term horizons. This ensures that the infrastructure banks are held accountable while retaining the ability to take risks and invest with a long-term focus. Finally, there needs to be a clear understanding of the trade-offs between the banks’ multiple objectives. For example, a project with high impact value may require a lower financial return target than a project with low impact value. Such a framework would help assess whether and how much concessional financing (i.e., reduced borrowing rates) is appropriate for a project depending on its impact value.

3. Priorities for Canada

Since Canadian infrastructure banks are young, there is much we can do to improve our policy framework to maximize the banks’ efficacy within the broader ecosystem of government departments and agencies. I summarize key priorities and policy considerations for Canada by drawing insights from international examples.

Securing a government commitment to private-sector infrastructure market development: In contrast to countries like the UK and Australia, most of Canada’s infrastructure assets – including airports, seaports, railways, and utilities – are publicly owned by federal, provincial, or municipal governments.15A recent working group, chaired by former Bank of Canada governor Stephen Poloz, was set up in 2024 to identify opportunities for Canadian pension funds to invest domestically in infrastructure and other markets. Recommendations from the working group include exploring changes to airport authority ground leases. See: https://financialpost.com/transportation/stephen-poloz-pension-funds-canadian-airports. The lack of infrastructure assets available for sale to other organizations has become a hot topic recently because it is one of the reasons why Canadian pension funds have decreased their domestic investments over the past decade (Dachis 2017; Ambachtsheer, Betermier, and Flynn 2024). Infrastructure is a strategic asset class for pension funds because it diversifies the funds’ assets, hedges against the funds’ liability risks, and provides opportunities for direct value creation and high-risk-adjusted returns (Beath, Betermier, Flynn and Spehner 2021). For infrastructure banks to successfully catalyze investment in infrastructure from private banks and large institutional investors, Canadian governments must actively support and commit to a private-sector role in the infrastructure market.

Establishing a unifying policy framework: Another priority for Canada is to establish a unifying policy framework that will help each infrastructure-oriented public agency to work in sync with one another. In 2016, the Government of Canada committed over C$180 billion for infrastructure projects across Canada over 12 years16See: https://housing-infrastructure.canada.ca/plan/about-invest-apropos-eng.html#3. to be delivered by over 20 federal departments and agencies, primarily in the form of grants and subsidies. Over the past decade, federal and provincial governments have also launched several investment-based funds to catalyze private investment in infrastructure. The federal government established the CIB in 2017 and the Canada Growth Fund in 2022. It announced in the December 2024 Fall Economic Statement its intention to launch new public investment funds to support the development of AI data centre projects, venture capital investments, and mid-cap growth companies.17See the Fall 2024 Economic Statement: https://www.budget.canada.ca/update-miseajour/2024/report-rapport/chap2-en.html#22-helping-businesses-grow. The Ontario government launched the Building Ontario Fund in 2023.18See: https://www.infrastructureontario.ca/en/news-and-media/news/general-news/ontario-infrastructure-bank/. These new organizations complement the well-established public development banks such as Export Development Canada and the Business Development Bank of Canada.

Having multiple grants and investment agencies operating in the same market means there is a high risk of competition between the agencies. In 2022, a legislative review found that several stakeholders continue to prefer traditional financing models to the alternative ones offered by infrastructure banks, partly because of stakeholder preference for public rather than private ownership and because grant and contribution programs come with fewer conditions.19According to section 4.3 of the review, “…the Review found some stakeholders continue to prefer traditional financing models to the alternative ones offered by the CIB. This was either because the CIB model is not suited to certain projects, or because of a stakeholder preference for public rather than private ownership and other forms of partnership. Some governments signaled a preference for grant and contribution programs with fewer conditions and objectives.” Source: https://housing-infrastructure.canada.ca/CIB-BIC/legislative-review-2017-2022-examen-loi-eng.html#Toc20. Coordination between these organizations, along with regular engagement with the private sector, will be critical in order to generate maximum engagement from the private sector.

Setting clear expectations: Another priority for Canada is to set clear expectations about the time it takes to properly set up an infrastructure bank and establish the right independent investment framework. For example, the CIB’s initial investment framework required each eligible investment to be specifically identified in a corporate plan approved by the Treasury Board. This process was time-consuming, unwieldy, and led to the delayed deployment of capital into projects. Consequently, from its inception in 2017 to 2020, the CIB made a single investment commitment totalling C$1.2 billion.20See: CIB 2021-2022 Annual Report, https://cdn.cib-bic.ca/files/documents/reports/en/Annual-Report-2021-2022.pdf. In 2020, the CIB established a new delegated investment framework that gave it operational autonomy. Consequently, between 2020 and 2024, the CIB made 78 investment commitments totalling over C$12 billion.21See: CIB Market Update, Feb. 25, 2025, https://cdn.cib-bic.ca/files/documents/reports/en/CIB-BIC-Quarterly-Financial-Report-Q3-2024-25.pdf

Learning from foreign infrastructure bank strategies: The comparative analysis of infrastructure banks in this paper provides several relevant policy considerations for Canada. For example, is there value in establishing an analogous system to the InvestEU model that provides loan guarantees to underwrite the risk of infrastructure projects? Also, when should private investors enter a deal? Presently, the CIB must secure private investment partnerships for a deal to move forward, whereas some other banks can move forward on a deal with the future expectation of private investors coming in.

These priorities and policy considerations highlight key risks and challenges that Canada must address to support the success of its infrastructure banks. These challenges are manageable, and I have provided several suggestions in this paper on how to address them. Policymakers assessing the size of these challenges should bear in mind that alternative policy tools face their own risks and challenges as well. Grants and subsidies can result in high levels of government investment that will not be recouped. State-sanctioned monopolies could lead to higher prices, reduced quality, and stifled innovation. Overall, this paper shows that infrastructure banks can play a central role in addressing Canada’s urgent and massive infrastructure needs – provided governments carefully design the policy framework and address key operational and governance challenges, such as crowding out versus crowding in private capital and ensuring effective performance measurement.

Conclusion

The analysis in this paper presents a strong theoretical and practical case for the infrastructure bank model. The infrastructure banks’ ability to take long-term risks, leverage the private sector’s business acumen and operational agility, and recoup their investment makes them a potentially powerful and cost-efficient policy tool to catalyze private investment in a wide range of infrastructure markets and encourage broader benefits in the economy. I have presented several strategies to address the governance and operational challenges infrastructure banks encounter when carrying out their mandates and support their success.

A quantitative analysis of the infrastructure banks’ performance will be an important next step in advancing the discussion. How successful are the banks’ investments over the long run, and which types of market failures do they resolve most effectively? And which infrastructure banks have built the most (and least) effective frameworks and structures, and what can we learn from them? We also need a better understanding of the investment requirements of different types of private investors that may partner with infrastructure banks, and how those requirements intersect with the banks’ projects. Infrastructure banks face many challenges, and they need to be carefully monitored and understood in order to reach their full potential.

The author thanks Colin Busby, Alexandre Laurin and Jeremy Kronick of the C.D. Howe Institute, as well as external reviewers Keith Ambachtsheer, Michael Fenn, Sarah Hobbs, and Mark Zelmer for helpful comments. The author thanks Travis Allan, Natasha Apollonova, Katherine Betermier, John Casola, Catherine Chan, Ehren Cory, Hannah Cook, Al Denholm, Jonathan Dugay-Arbesfeld, Russ Culverwell, Richard Francella, Brian Friesen, Sashen Guneratna, Megan Hodapp, Waruna Karunaratne, Clint Kellum, Joel Kenrick, Jenny Lackey, Rory Lonergan, Viktor Martelin, Oriane Pacic, Andrew Posluns, Steven Robins, Heechung Sung, Dan Taylor, Hillary Thatcher, Jeanette Vitasp, Mike Wedderspoon, and Scott Wu for valuable insights. Pierre Emelina and Gabriel Podolsky provided excellent research assistance.

The author acknowledges the support of the Canada Infrastructure Bank. The views and opinions expressed in this paper are solely those of the author and do not reflect those of McGill, the International Centre for Pension Management (ICPM), or the C.D. Howe Institute. All errors are those of the author.

References

Ambachtsheer, Keith, 2021. “The Canadian Pension Model: Past, Present, and Future.” Journal of Portfolio Management 47(5): 150-158.

Ambachtsheer, Keith, Sebastien Betermier, and Chris Flynn. 2024. “Should Canada Require its Pension Funds to Invest More Domestically?” Global Risk Institute.

Beath, Alexander D., Sebastien Betermier, Chris Flynn, and Quentin Spehner. 2021. “The Canadian Pension Fund Model: A Quantitative Portrait.” Journal of Portfolio Management 47(5): 159-177.

Boyer, Marcel, Éric Gravel, and Sandy Mokbel. 2013. The Valuation of Public Projects: Risks, Cost of Financing and Cost of Capital. Commentary 388. Toronto: C.D. Howe Institute. September.

Carvalho, Daniel. 2014. “The real effects of government-owned banks: evidence from an emerging market.” Journal of Finance 69(2): 577-609.

Dachis, Benjamin. 2017. New and Improved: How Institutional Investment in Public Infrastructure can Benefit Taxpayers and Consumers. Commentary 473. Toronto: C.D. Howe Institute. March.

Fernández-Arias, Eduardo, Ricardo Hausman, and Ugo Panizza. 2020. “Smart Development Banks.” Journal of Industry, Competition, and Trade 20: 395-420.

Global Infrastructure Hub and Oxford Economics. 2018. “Global Infrastructure Outlook: Infrastructure Investment Needs, 56 Countries, 7 Sectors to 2040.” Global Infrastructure Hub.

Griffith-Jones, Stephany, and José Antonio Ocampo (Eds.). 2018. The Future of National Development Banks. Oxford University Press.

Istrate, Emilia, and Robert Puentes. 2011. “Moving Forward on Public Private Partnerships: U.S. and International Experience with PPP Units.” Brookings-Rockefeller Project on State and Metropolitan Innovation.

Kim, Jinsoo, Benjamin K. Sovacool, Morgan Bazilian, Steve Griffiths, Junghwan Lee, Minyoung Yang, and Jordy Lee. 2022. “Decarbonizing the Irom and Steel Industry: A Systematic Review of Sociotechnical Systems, Technological Innovations, and Policy Options.” Energy Research and Social Science 89: 1-32.

Marois, Thomas. 2024. “Public development banks as essential infrastructure: Covid, the KfW, and public purpose.” Review of Political Economy (2024): 1-25.

Mazzucato, Mariana, and Caetano C.R. Penna. 2016. “Beyond market failures: the market creating and shaping roles of state investment banks.” Journal of Economic Policy Reform 19(4): 305-326.

Mazzucato, Mariana. 2018. The Entrepreneurial State: Debunking Public vs. Private Sector Myths. Penguin Books.

Oughton, Edward, David Amaglobeli, and Mariano Moszoro. 2023. “Estimating Digital Infrastructure Investment Needs to Achieve Universal Broadband.” International Monetary Fund, IMF Working Paper 23/27.

World Bank Group. 2017. “The Evolution of the Canadian Pension Model: Practical Lessons for Building World-Class Pension Organizations.” Washington, DC: International Bank of Reconstruction and Development/World Bank.

Related Publications

- Research