Home / Publications / Intelligence Memos / Stripping Mortgages from the CPI Can be a Useful Tool

- Intelligence Memos

- |

Stripping Mortgages from the CPI Can be a Useful Tool

Summary:

| Citation | Steve Ambler and Kronick, Jeremy. 2025. "Stripping Mortgages from the CPI Can be a Useful Tool." Intelligence Memos. Toronto: C.D. Howe Institute. |

| Page Title: | Stripping Mortgages from the CPI Can be a Useful Tool – C.D. Howe Institute |

| Article Title: | Stripping Mortgages from the CPI Can be a Useful Tool |

| URL: | https://cdhowe.org/publication/stripping-mortgages-from-the-cpi-can-be-a-useful-tool/ |

| Published Date: | May 20, 2025 |

| Accessed Date: | November 15, 2025 |

Outline

Outline

Authors

Related Topics

Files

To: Canadian inflation watchers

From: Steve Ambler and Jeremy M. Kronick

Date: May 20, 2025

Re: Stripping Mortgages from the CPI Can be a Useful Tool

Our recent C.D. Howe Institute E-Brief examined the role of the mortgage interest cost component of the consumer price index (CPI) in influencing the overall dynamics of the CPI, particularly in response to large swings in the Bank of Canada’s overnight interest rate target.

As part of generating the CPI, Statistics Canada must consider how to factor in the cost of owning a home. Part of its approach is to create a mortgage interest cost index (MIC) that takes into account both house prices themselves and mortgage interest rates.

The target overnight rate has a direct and almost immediate effect on the latter. A substantial fraction – though not the majority – of all mortgages in Canada are variable-rate, which means that when the Bank of Canada increases or decreases the overnight rate, the MIC changes immediately. There is a lagged effect on fixed-rate mortgages as they gradually come up for renewal. The impact on mortgage interest costs is then transmitted to the MIC component of the CPI, increasing measured inflation when interest rates increase and decreasing it when they decrease.

The house price effect typically offsets some of the mortgage interest rate component since interest rate increases tend to dampen house prices and decreases tend to bolster them. However, the house price effect occurs with a lag because the amortization on homes is usually 25 or 30 years, and so the mortgage interest rate component often dominates.

Because the mortgage interest rate component plays an outsized role, the net effect of the MIC is to depress CPI (headline) inflation during and after monetary policy easing cycles, like the one at the beginning of the pandemic, and to boost it when the Bank of Canada is engaged in a tightening cycle (as it was between March 2022 and July 2023) or when the Bank’s policy rate remains high after a tightening cycle.

The year-over-year rate of mortgage interest cost inflation was still 10.2 percent in January 2025 (the last number available at time of writing of our E-Brief). This was adding about 0.5 percentage points to headline inflation. Stripping out the MIC component, inflation has been at or below the Bank’s 2-percent target since the beginning of 2024 (except for May 2024 when it was 2.1 percent).

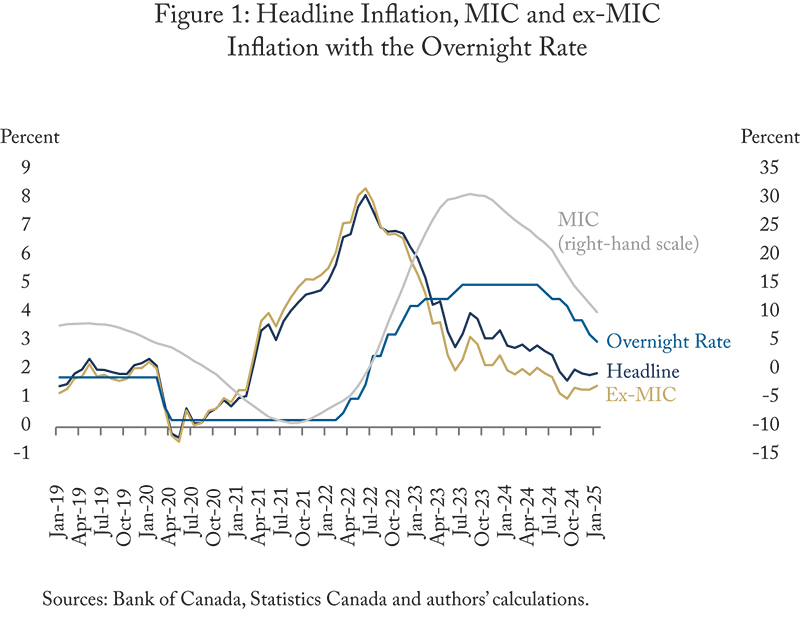

The Figure below shows the dynamic relationships among the variables are complicated. MIC inflation, (rescaled to fit on the graph and measured on the right-hand) is fairly directly linked to the policy rate. It remained above the rate of headline inflation throughout 2019 and into the start of the pandemic. It began decreasing sharply starting in March 2020 as the policy rate hit its lower bound. It dropped below the rate of headline inflation in September 2020 and turned negative the month after. It remained negative during the entire period when the policy rate was at the lower bound.

When the policy rate started rising in March 2022, so did MIC inflation. The latter turned positive in July 2022 when the policy rate was 2.5 percent, overtook headline inflation two months later (8.3 percent vs. 6.9 percent) and continued rising rapidly along with the policy rate. MIC inflation peaked at 30.9 percent in August 2023, one month after the policy rate hit its peak of 5.0 percent.

While mortgage interest costs are a component of consumers’ consumption baskets and should be included in the overall CPI, we argue that stripping them out of headline inflation would give a better idea in some circumstances of where inflation is headed in the medium term, in particular following big swings in the Bank of Canada’s policy rate.

We base this conclusion on an empirical analysis that looks at several possible measures of inflation and analyzes their predictive capacity for the evolution of headline inflation when the Bank of Canada is engaged in a tightening or an easing cycle.

While we do not suggest that the mortgage interest cost component be stripped out of the CPI, our results show that measuring inflation after stripping out mortgage interest costs can be a tool to help anticipate the future evolution of inflation in specific circumstances – in particular during and after major monetary policy tightening and easing cycles.

Steve Ambler, professor of economics at Université du Québec à Montréal, is the David Dodge Chair in Monetary Policy at the C.D. Howe Institute, where Jeremy M. Kronick is Vice-President, Economic Analysis and Strategy, and director of the Centre on Financial and Monetary Policy.

To send a comment or leave feedback, email us at blog@cdhowe.org.

The views expressed here are those of the author. The C.D. Howe Institute does not take corporate positions on policy matters.

Want more insights like this? Subscribe to our newsletter for the latest research and expert commentary.

Related Publications

- Opinions & Editorials

- Research