Home / Publications / Council Reports / C.D. Howe Institute Monetary Policy Council Calls for Bank of Canada to Cut Overnight Rate to 2.50 Percent Next Week and 2.25 Percent in 6 Months

- Council Reports

- |

C.D. Howe Institute Monetary Policy Council Calls for Bank of Canada to Cut Overnight Rate to 2.50 Percent Next Week and 2.25 Percent in 6 Months

Summary:

| Citation | . 2025. "C.D. Howe Institute Monetary Policy Council Calls for Bank of Canada to Cut Overnight Rate to 2.50 Percent Next Week and 2.25 Percent in 6 Months." Council Reports. Toronto: C.D. Howe Institute. |

| Page Title: | C.D. Howe Institute Monetary Policy Council Calls for Bank of Canada to Cut Overnight Rate to 2.50 Percent Next Week and 2.25 Percent in 6 Months – C.D. Howe Institute |

| Article Title: | C.D. Howe Institute Monetary Policy Council Calls for Bank of Canada to Cut Overnight Rate to 2.50 Percent Next Week and 2.25 Percent in 6 Months |

| URL: | https://cdhowe.org/publication/mpcmay29/ |

| Published Date: | May 29, 2025 |

| Accessed Date: | February 1, 2026 |

Outline

Outline

Related Topics

Files

For all media inquiries, including requests for reports or interviews:

May 29, 2025 – The C.D. Howe Institute’s Monetary Policy Council (MPC) calls for the Bank of Canada to lower its target for the overnight rate, its benchmark policy interest rate, from 2.75 percent to 2.50 percent at its next announcement on June 4th. The MPC further calls for the Bank to leave the target at 2.50 percent at its subsequent announcement in July but cut again to 2.25 percent by the end of the year.

The MPC provides an independent assessment of the monetary stance consistent with the Bank of Canada’s 2 percent inflation target. MPC co-chair William B.P. Robson, the Institute’s President and CEO, chaired this meeting. MPC members make recommendations for the Bank of Canada’s target for the overnight rate at its upcoming announcement, the subsequent announcement, and the announcements six months and one year ahead. The Council’s formal recommendation for each announcement is the median vote of members attending the meeting.

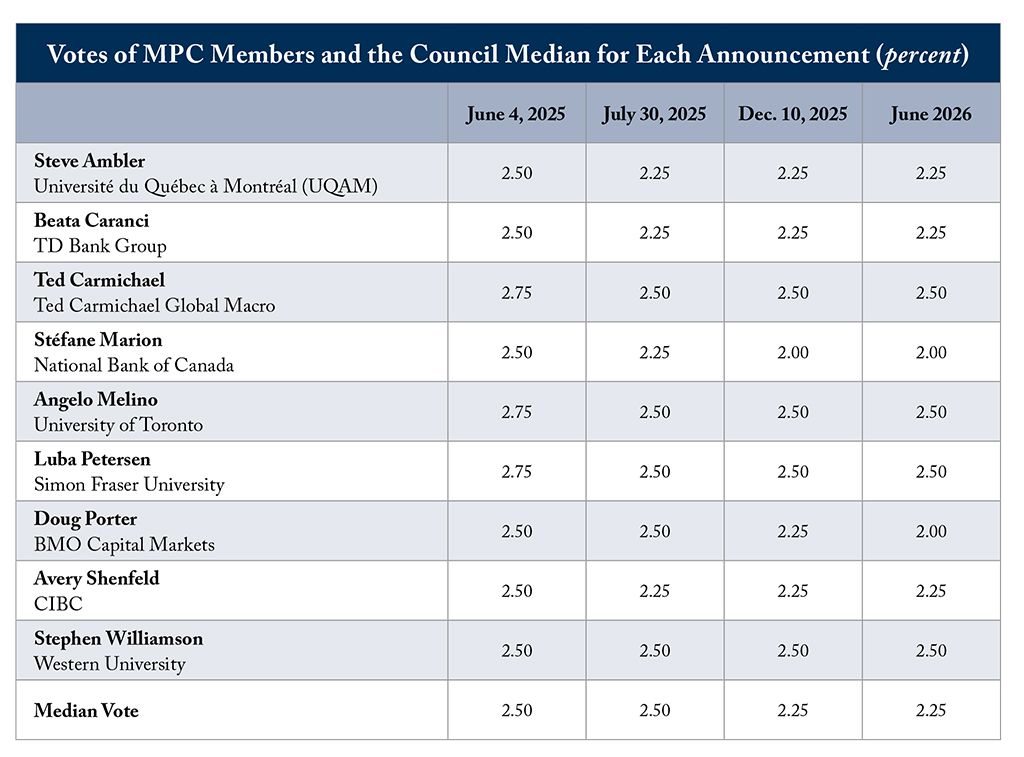

Six of the nine MPC members attending the meeting recommended the cut next week, with the other three recommending no change. Looking ahead to July, the unchanged median vote masked a strong change in sentiment: no members recommended 2.75 percent; five recommended 2.50 percent, and four recommended 2.25 percent. By December, one member recommended 2.00 percent, four recommended 2.25 percent and four recommended 2.50 percent, dropping the median to 2.25. The votes for June of 2026 were not much different, with two members recommending 2.00 percent, three recommending 2.25 percent, and four recommending 2.50 percent (see table below).

The dominant theme in the conversation was the contrast between weakening measures of economic activity and stubbornly high measures of inflation. Several participants emphasized weak job numbers, particularly recent payroll employment reports and job losses in the prime age group, as decisive indicators that demand is flagging and a disinflationary output gap is opening up. Others noted that looking through the impact of the elimination of the consumer carbon tax on the total CPI, various measures of underlying inflation were above two percent and, in many cases, rising. On balance, the group judged that the weakening economy would reduce inflationary pressure. Members arguing against a cut next week said that the Bank of Canada should wait for better inflation numbers before moving. Some members arguing for a cut – including two bank economists whose recommendations for a cut contrasted with their published forecasts that the Bank will keep the target unchanged – said that the weak labour market, and the likelihood of soft upcoming numbers for real GDP in April and in the second quarter, tilted the balance in favour of an immediate move.

The most salient uncertainty highlighted in the discussion was the trade outlook, notably the prospects for President Trump to pursue his tariff attacks in the face of opposition in the courts and elsewhere. Although many in the group were optimistic that the United States will ultimately impose much lower tariffs than those Trump has often threatened, the general assessment was that trade uncertainty is undermining confidence everywhere and is a material negative for Canadian consumption and investment.

The group commented on the conundrums the Bank of Canada faces – which, in addition to these tensions and uncertainties, include mixed readings from the housing market, an appreciating Canadian dollar at a time when the terms of trade are deteriorating, and fiscal uncertainties, exacerbated by a delayed federal budget. Some members commented that the Bank should revert to presenting a central-tendency forecast, potentially updated more frequently than the current schedule for Monetary Policy Reports. Others noted that measured reactions are appropriate in the face of such uncertainty and that the exact timing of changes in the overnight rate was not critical to the inflation outlook.

The views and opinions expressed by the participants are their own and do not necessarily reflect the views of the organizations with which they are affiliated, or those of the C.D. Howe Institute. Forecasters’ recommendations may differ from their predictions.

The MPC’s next vote will take place on July 24, 2025, prior to the Bank of Canada’s overnight rate announcement on July 30.

* * * * *

For more information, contact: Mawakina Bafale, Research Officer, e-mail: mbafale@cdhowe.org and Lauren Malyk, Manager, Communications, e-mail: lmalyk@cdhowe.org

Related Publications

- Intelligence Memos