Home / Publications / Council Reports / Bank of Canada Should Cut Overnight Rate to 2.25 Percent, then Hold, Says C.D. Howe Institute Monetary Policy Council

- Council Reports

- |

Bank of Canada Should Cut Overnight Rate to 2.25 Percent, then Hold, Says C.D. Howe Institute Monetary Policy Council

Summary:

| Citation | . 2025. "Bank of Canada Should Cut Overnight Rate to 2.25 Percent, then Hold, Says C.D. Howe Institute Monetary Policy Council." Council Reports. Toronto: C.D. Howe Institute. |

| Page Title: | Bank of Canada Should Cut Overnight Rate to 2.25 Percent, then Hold, Says C.D. Howe Institute Monetary Policy Council – C.D. Howe Institute |

| Article Title: | Bank of Canada Should Cut Overnight Rate to 2.25 Percent, then Hold, Says C.D. Howe Institute Monetary Policy Council |

| URL: | https://cdhowe.org/publication/mpcoctober2025/ |

| Published Date: | October 23, 2025 |

| Accessed Date: | November 15, 2025 |

October 23, 2025 – The C.D. Howe Institute’s Monetary Policy Council (MPC) calls for the Bank of Canada to cut its target for the overnight rate, its benchmark policy interest rate, to 2.25 percent at its next announcement on October 29th. The MPC then calls for the Bank to leave the target at 2.25 percent over the next year.

The MPC, chaired at this meeting by Jeremy Kronick, the Institute’s Vice-President, Economic Analysis and Strategy, includes the chief economists of the six largest Canadian banks, alongside six leading academic economists and financial market experts.

Acting as a shadow Governing Council, the MPC provides an independent assessment of the monetary stance needed to support the Bank of Canada’s 2 percent inflation target. Its formal recommendation for each interest rate announcement is determined by the median vote of members in attendance. Members vote on the upcoming announcement, the subsequent announcement, and the announcements six months and one year ahead.

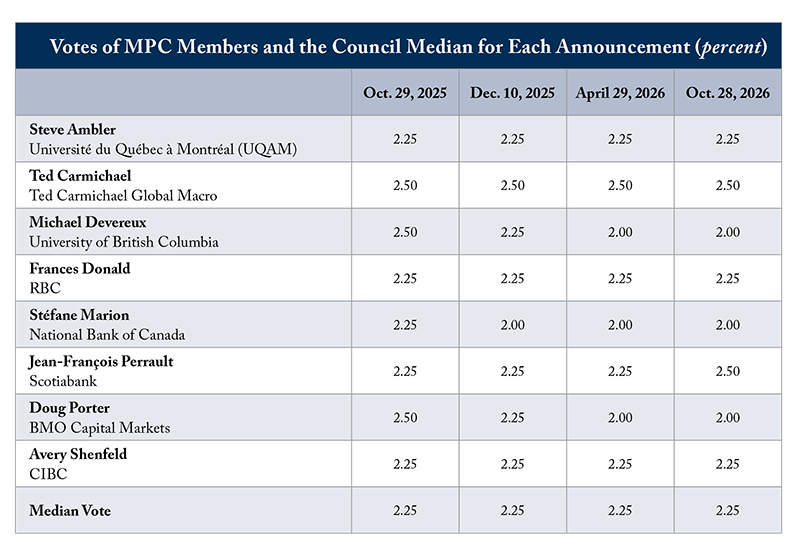

Five of the eight MPC members attending the meeting recommended the Bank of Canada cut the target for the overnight rate to 2.25 percent next week, with the other three recommending they leave it at 2.50 percent. Looking ahead to December, six members recommended the Bank leave the overnight rate target at 2.25 percent, while one member recommended a rate of 2.50 percent and another recommended a further cut to 2.00 percent. By next April, four members still recommended a rate of 2.25 percent, three said the Bank should target a 2.00 percent overnight rate, and one argued for a rate of 2.50 percent. Members repeated their April votes as they looked ahead to October 2026, except for one member who tightened from 2.25 percent to 2.50 percent (see table below).

Members discussed the conflicting signs faced by the Bank of Canada. On the one hand, headline inflation in September spiked to 2.4 percent, and core inflation measures remained above 3 percent, at 3.1 percent for CPI-trim and 3.2 percent for CPI-median. On the other hand, the economy has clear signs of weakness. Exports were down nearly 30 percent in the second quarter, and despite strong job numbers in September, members were doubtful of their staying power, in particular given the weak hiring and investment plans in the Business Outlook Survey. Members noted the economy’s potential is highly uncertain as a result of the continued trade wars and the negotiations still to come. This environment makes it difficult to determine the output gap and what it will mean for inflation.

Members considered what lessons can be drawn from the inflation numbers. On headline inflation, the increase was driven by spikes in gas and food prices. Members noted how the different underlying inflation measures tell different stories. Inflation without gasoline, looked at from December to September, was still elevated. However, taking out food from that calculation, inflation returned closer to target. Given these conflicting signals, members noted the importance of monetary policy being forward-looking and asking where inflation will be one-to-two years out. Some members argued for caution given the continued elevated core inflation measures.

Members also discussed the upcoming announcement in the context of a key piece of missing information: the federal budget, to be tabled on November 4th. The budget is complicated in that it could add to labour market weakness if there is a shrinking in the public sector labour force, while at the same time, indications are that there will be a significant amount of government spending and investment. Members argued it was difficult to know the overall impact on the economy and inflation without knowing not only where the spending is going, but also the timing of that spending.

Lastly, members discussed Canada’s relatively easy financial conditions. Members felt that a further easing would act as an insurance premium, and with a sleepy housing market, was not likely to create undue risks. Members also pointed out that despite these easy conditions, it has not led to improved business investment and a boost to the economy.

The views and opinions expressed by the participants are their own and do not necessarily reflect the views of the organizations with which they are affiliated, or those of the C.D. Howe Institute. Forecasters’ recommendations may differ from their predictions.

The MPC’s next vote will take place on December 4, 2025, prior to the Bank of Canada’s overnight rate announcement on December 10.

* * * * *

For more information, contact: Lauren Malyk, Manager, Communications, 416-873-6168, lmalyk@cdhowe.org.

Want more insights like this? Subscribe to our newsletter for the latest research and expert commentary.

Related Publications

- Opinions & Editorials

- Research