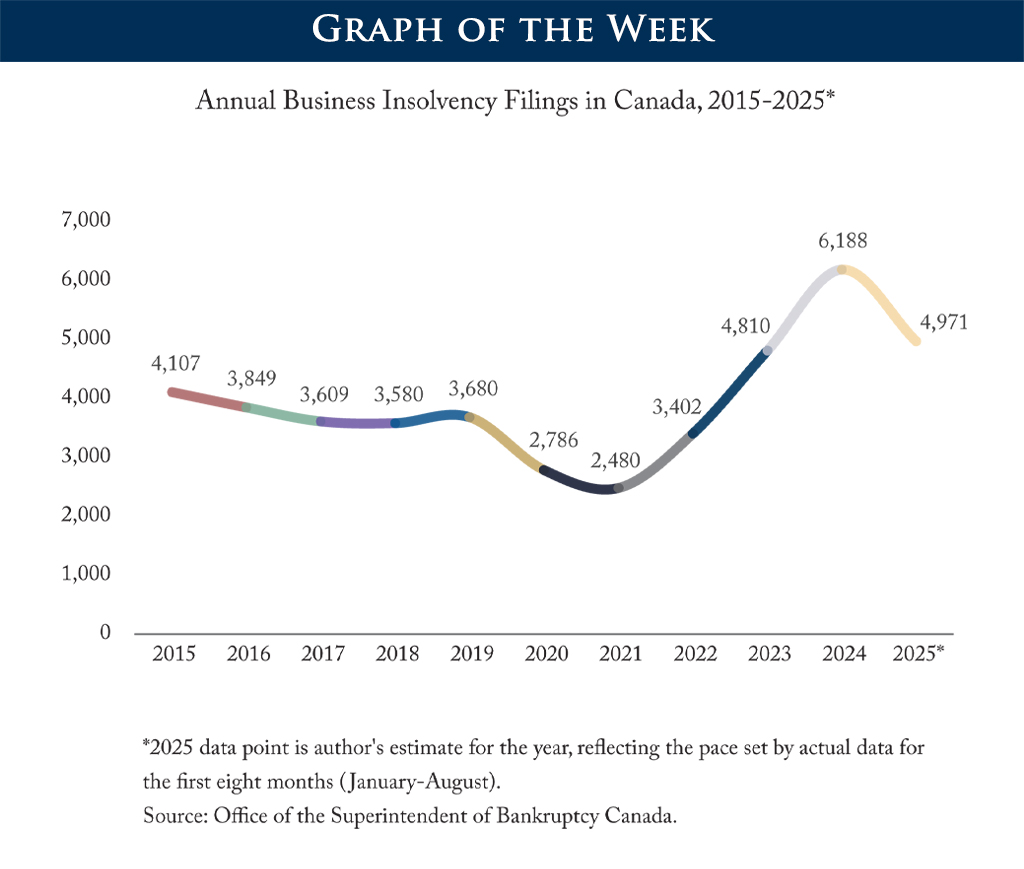

Business Insolvencies Climb to a 10-Year High

Business insolvencies surged to 6,188 in 2024 – the highest level in the past 10 years and a 150 percent increase from the 2021 low. As government support programs ended and interest rates climbed, insolvencies rebounded sharply. While data for 2025 to date suggests some stabilization, insolvencies are on pace to remain well above pre-pandemic norms […]

Business insolvencies surged to 6,188 in 2024 – the highest level in the past 10 years and a 150 percent increase from the 2021 low. As government support programs ended and interest rates climbed, insolvencies rebounded sharply. While data for 2025 to date suggests some stabilization, insolvencies are on pace to remain well above pre-pandemic norms […] Canadian Economy Contracts, But Does Not Meet Recession Definition

Canada’s real gross domestic product (GDP) declined by 0.4 percent in the second quarter of 2025, driven by a 7.5 percent drop in exports and a 9.4 percent drop in investment in machinery and equipment. The decline was steeper than had been forecast, prompting the Bank of Canada to cut its policy rate. The drop […]

Canada’s real gross domestic product (GDP) declined by 0.4 percent in the second quarter of 2025, driven by a 7.5 percent drop in exports and a 9.4 percent drop in investment in machinery and equipment. The decline was steeper than had been forecast, prompting the Bank of Canada to cut its policy rate. The drop […] Canada Is Not in a Recession Despite GDP Decline, Council Finds

September 22, 2025 – Canada’s economy shrank in the second quarter of 2025, but conditions do not yet meet the definition of a recession, according to a new Communiqué from the C.D. Howe Institute’s Business Cycle Council (BCC). In “Canadian Economy Contracts, But Does Not Meet Recession Definition,” the Council notes that real GDP fell […]Jeremy M. Kronick and Steve Ambler – Sooner Rather than Later Needed for More Rate Cuts

To: Inflation Watchers From: Jeremy M. Kronick and Steve Ambler Date: October 28, 2024 Re: Sooner Rather than Later Needed for More Rate Cuts The inflation beast is looking considerably weaker. Between the Bank of Canada’s rate announcement on September 4 and its announcement last Wednesday, Statistics Canada released two of its monthly reports on the consumer price index. They […]

To: Inflation Watchers From: Jeremy M. Kronick and Steve Ambler Date: October 28, 2024 Re: Sooner Rather than Later Needed for More Rate Cuts The inflation beast is looking considerably weaker. Between the Bank of Canada’s rate announcement on September 4 and its announcement last Wednesday, Statistics Canada released two of its monthly reports on the consumer price index. They […] Jeremy M. Kronick on BNN Bloomberg – How a 2% interest rate could impact mortgage rates

As Canada stays on track for a 2 percent inflation rate, what could this mean for mortgage rates? Jeremy M. Kronick, Vice-President, Economic Analysis and Strategy at the C.D. Howe Institute, explains.

Jeremy M. Kronick on BNN Bloomberg – Bank of Canada delivers 50 bps rate cut

Jeremy M. Kronick, Vice-President, Economic Analysis and Strategy at the C.D. Howe Institute, joins BNN Bloomberg to talk about The Bank of Canada delivering 50 bps rate cut.

Kronick, Ambler – Predicting (and Confirming) Business Cycles in Canada

To: Recession forecasters From: Jeremy M. Kronick and Steve Ambler Date: May 24, 2024 Re: Predicting (and Confirming) Business Cycles in Canada A recent staff working paper by Temel Taskin and Franz Ulrich Ruch at the Bank of Canada uses a sophisticated model – a dynamic autoregressive (AR) probit model – and business cycle turning points published by the C.D. Howe […]

To: Recession forecasters From: Jeremy M. Kronick and Steve Ambler Date: May 24, 2024 Re: Predicting (and Confirming) Business Cycles in Canada A recent staff working paper by Temel Taskin and Franz Ulrich Ruch at the Bank of Canada uses a sophisticated model – a dynamic autoregressive (AR) probit model – and business cycle turning points published by the C.D. Howe […] Business Cycle Council

Comprised of our country’s preeminent economists, the C.D. Howe Institute’s Business Cycle Council is an arbiter of business cycle dates in Canada. The Council meets annually, or when economic conditions indicate the possibility of entry to, or exit from, a recession, and acts as a conduit for understanding how the economy evolves.The Council performs a similar […]

Comprised of our country’s preeminent economists, the C.D. Howe Institute’s Business Cycle Council is an arbiter of business cycle dates in Canada. The Council meets annually, or when economic conditions indicate the possibility of entry to, or exit from, a recession, and acts as a conduit for understanding how the economy evolves.The Council performs a similar […] So Far, So Good: C.D. Howe Institute Business Cycle Council Declares Recession Avoided in 2022, 2023

Weakness in Canadian GDP since the Bank of Canada began raising its policy rate in March 2022 has spurred much talk of the possibility of a recession.1At a meeting in early 2024, the Council weighed the evidence of a recession having occurred in the past two years and whether current conditions could presage one. The […]

Weakness in Canadian GDP since the Bank of Canada began raising its policy rate in March 2022 has spurred much talk of the possibility of a recession.1At a meeting in early 2024, the Council weighed the evidence of a recession having occurred in the past two years and whether current conditions could presage one. The […] Canada Dodged Recession, Risks Remain in 2024

March 27, 2024 – Canada avoided a recession in the last two years but risks remain for 2024, according to the C.D. Howe Institute’s Business Cycle Council (BCC).

In “So Far, So Good: C.D. Howe Institute Business Cycle Council Declares Recession Avoided in 2022, 2023,” members of the BCC examined if a recession had occurred in the past two years and found that the Canadian economy did not fulfill the conditions required to indicate a recession.

C.D. Howe Institute Business Cycle Council (BCC) is an authoritative arbiter of business cycle dates in Canada. The BCC meets when economic conditions indicate the possibility of entry to, or exit from, a recession and acts as a conduit for research aimed at developing a deeper…

We must do away with ‘zombie governance’ in the corporate world – Globe and Mail

In the book Zombie Economics, John Quiggin explained how dead ideas – assumptions about market economics refuted by the 2008-09 financial crisis – live on in the minds of many people, including those charged with cleaning up the mess. While not supported by evidence or analysis, these narratives persist as “dead ideas that still walk among us.” Why? Largely because they advance the interests of particular (typically elite) groups who want to believe in them and make them true.

Likewise, corporate governance best practices are typically based on intuition, opinion and rhetoric. Such thinking has been elevated – mandated by regulators and rated by a burgeoning class of governance experts for whom such standards become self-…

Overly optimistic Liberals are lowballing government debt risk – Financial Post

In its November Fall Economic Statement, the federal government presented a long-term projection that shows its debt ratio — that is, federal debt divided by GDP — declining smoothly over the next 30 years. But this outcome follows from overly optimistic assumptions about interest rates and program spending, and a decision to ignore the impact of recessions, which are certain to happen in any 30-year period. Taking such a rosy approach to debt sustainability allows the government to avoid making the hard choices on spending and taxes that no government likes.

Ottawa’s analysis assumes the effective interest rate on federal debt remains below the growth rate of the economy from now all the way to 2055-56. This sunny…